Savings is one of the ways to solve impromptu expenses. It is also a means to grow your income while running your day-to-day activities. In the olden times, this was done by crude methods.

Either Inside a Mattress, or In a Piggy Bank, or in a Treasure Chest, and many others. These methods weren’t secure at all. Thanks to modernization, there’s been improved ways to save money.

5 Money-Saving Apps 2022

Whether you save in the lowest denomination or largest, it all counts. Don’t underestimate the power of saving. That smallest denomination you save today would count tomorrow. To aid your savings, money-saving apps have come to make saving money easier.

It’s much more beneficial than the popular Kolo or piggy box you have in your home. This way, your money is secured and discipline not to spend them is maintained.

These money-saving apps aid you in your saving journey. Additionally, they offer financial tips to adopt in your finances.

Here are a few of them.

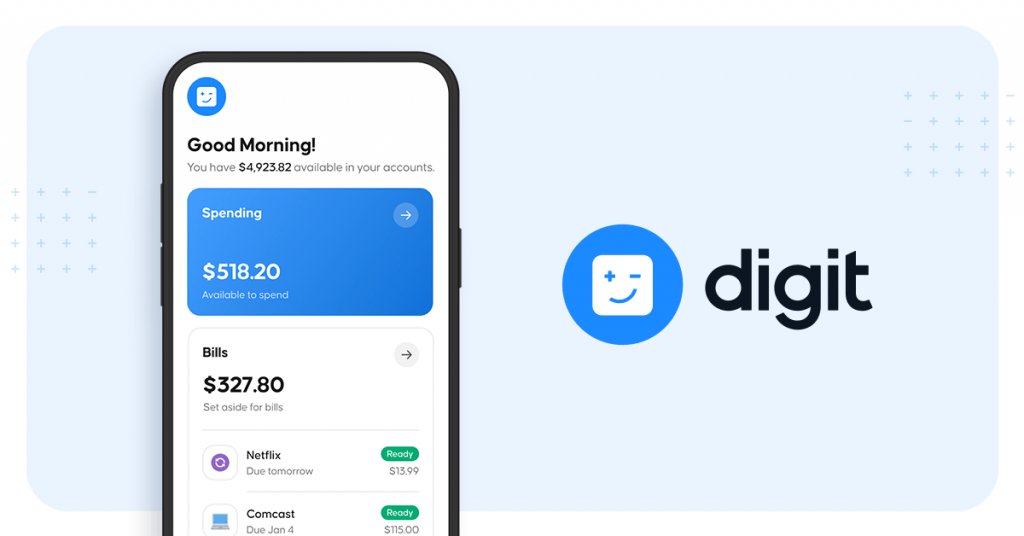

Digit

It’s an automated saving app. This means you don’t need to manually save, just sign up once and input the amount you’ll like to save daily or monthly.

It debits your bank account and credits the savings account you created with them.

This app is advisable for impulse and indisciplined persons. It offers a 30-day trial and afterwards, charges subscribers $5 a month. This activates the auto-saving feature and the ability to use the app to achieve your saving goals.

It watches your financial status if you’re ready to save and also refunds an overdraft. You also earn a 0.1 percent annual savings bonus every three months. A saving app to try out.

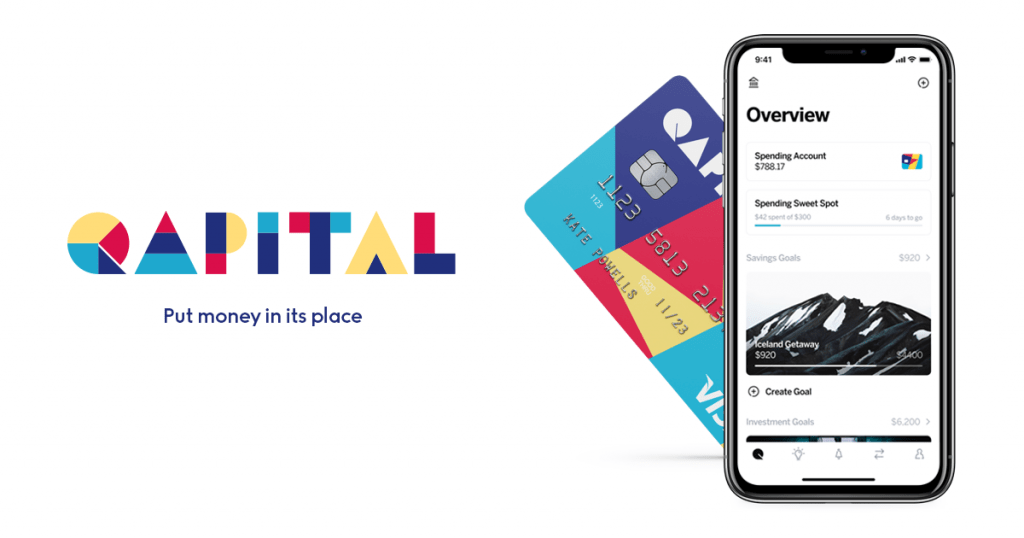

Qapital

A saving app that lets users set their saving rules. You can set up a rule that withdraws money from your account at every enjoyment expense.

For instance, if you get a plate of ice cream for $4, it withdraws like 50 cents or more from your bank account to your savings account in the app.

It has features that enable you to add pictures to your saving goals. To subscribe to this app, you either sign up or link up to an existing subscribed account.

It’s good for investments and long-term saving goals. You subscribe to a particular plan to enjoy the features attached to it.

You can also set a fixed amount to automatically fund your saving account daily. With a 30-day free trial, you subscribe to a basic plan afterwards with $3 monthly. You earn an interest of 0.1% If you work better visualizing your goals, then this is for you.

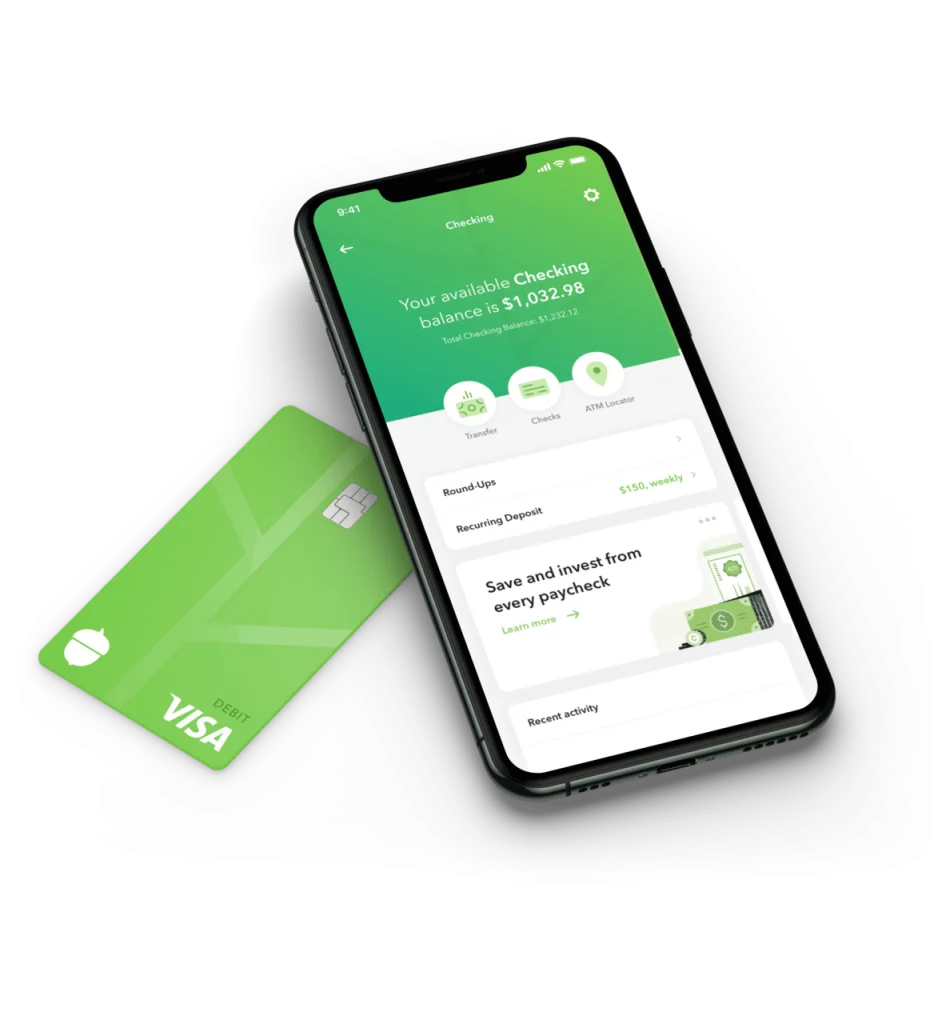

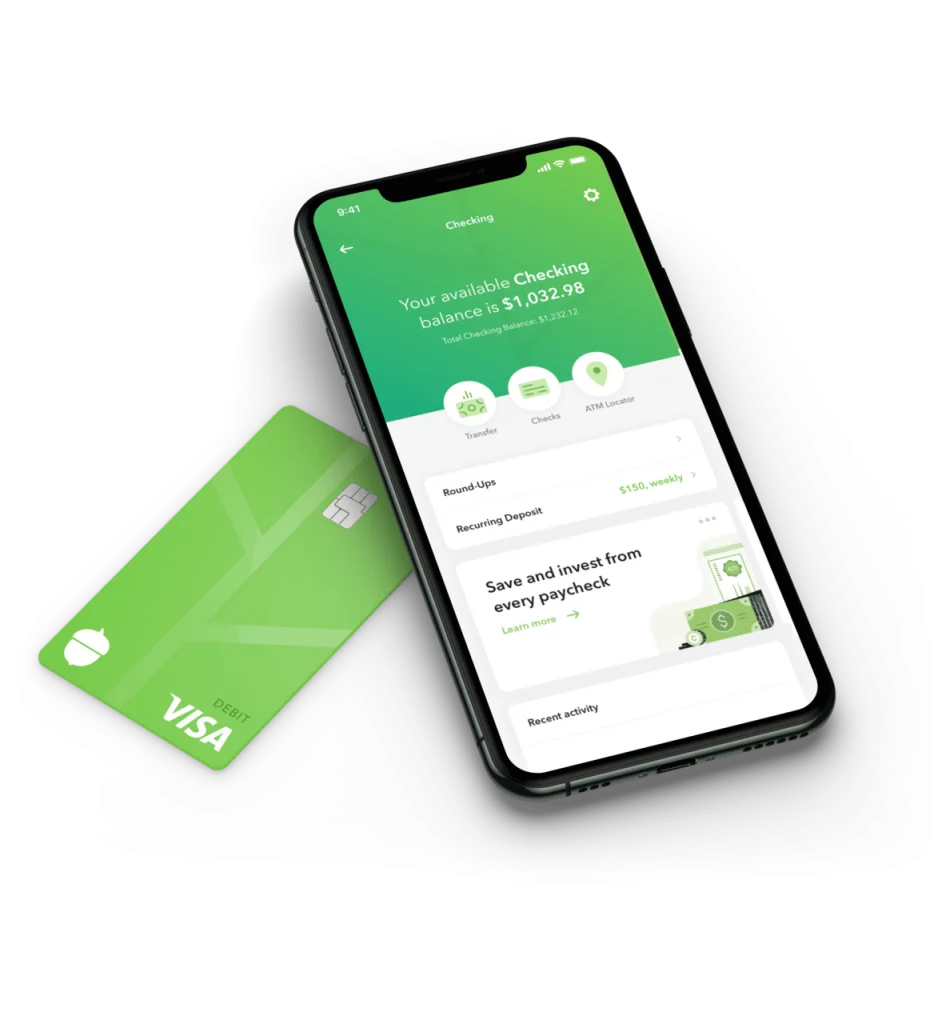

Acorns

Just like Qapital, it rounds up your purchases to the nearest dollar and automatically adds the difference from your checking account to your Acorn investment account.

For the basic plan, it costs $3 per month. This covers checking, investing, and retirement accounts.

To add investment accounts for kids, there’s a $5 monthly fee option.

It’s composed of exchange-traded funds (generally a basket of stocks and bonds) and options that range having a higher percentage of bonds (Conservative) to having higher percentage of stocks (Agressive).

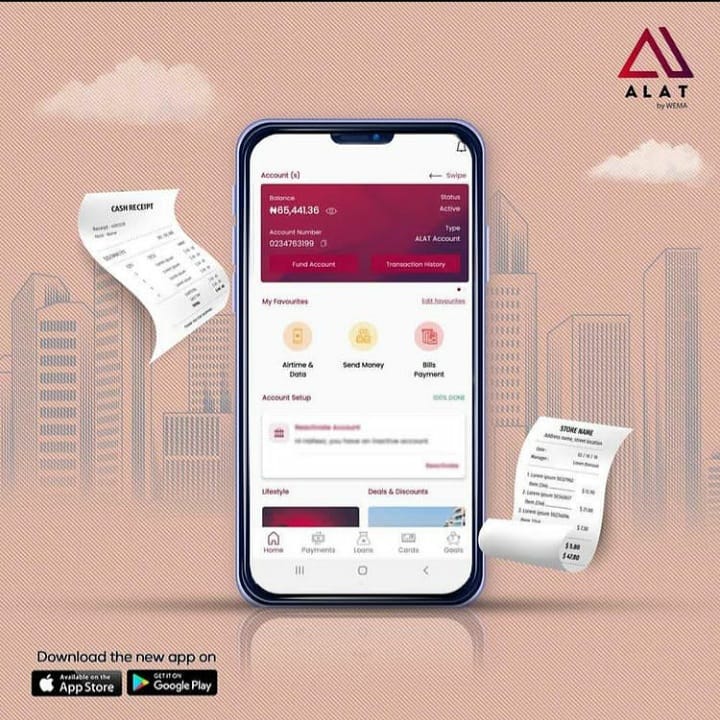

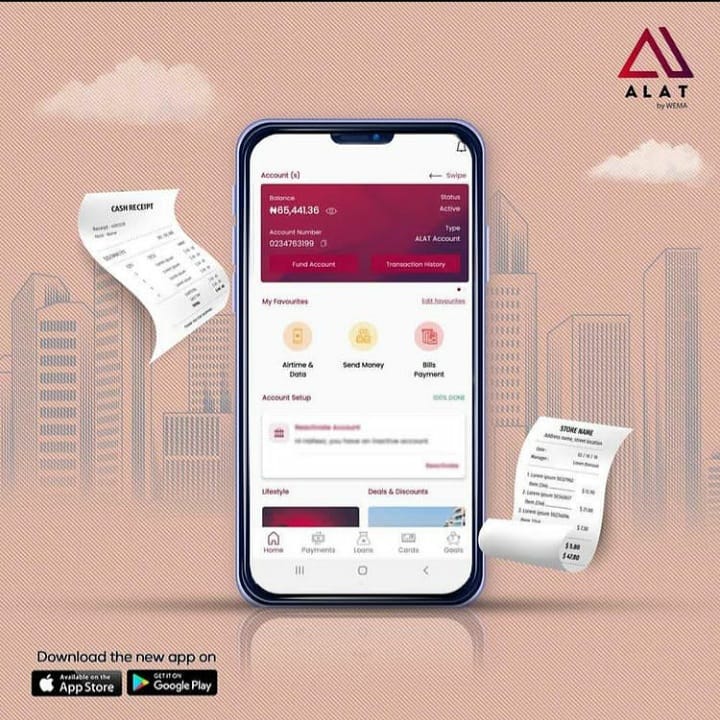

ALAT

This is Nigeria’s ever fully digital bank at the top of the list. A digital bank for WEMA bank. This is an added benefit for customers of the bank.

The transactional process can be done in the comfort of your home with your electronic device without you physically appearing at the bank.

With an interest rate of up to 8.75% on your saved amount per annum. A whopping three times the standard bank rate!

An account can be opened in minutes. Firstly, download the app from the Google Play Store or the Apple App Store. Then upload all necessary details to create the account.

It also allows you to set your saving goals and choose your saving method, either with friends or alone. An interesting thing is that the interest rate on your savings is up to 4.2% if you don’t withdraw more than thrice a month.

It has benefits an actual bank account can offer, from a debit card to a bank account to even having a virtual dollar card for online and foreign transactions.

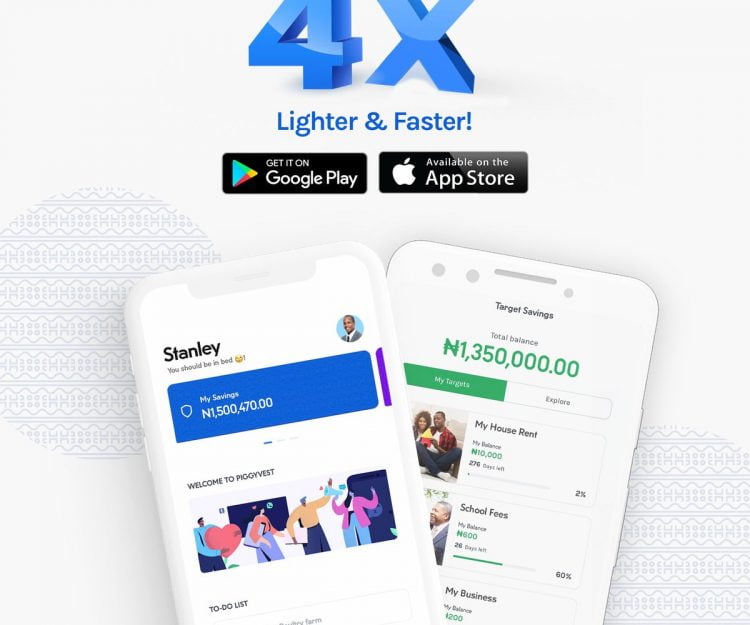

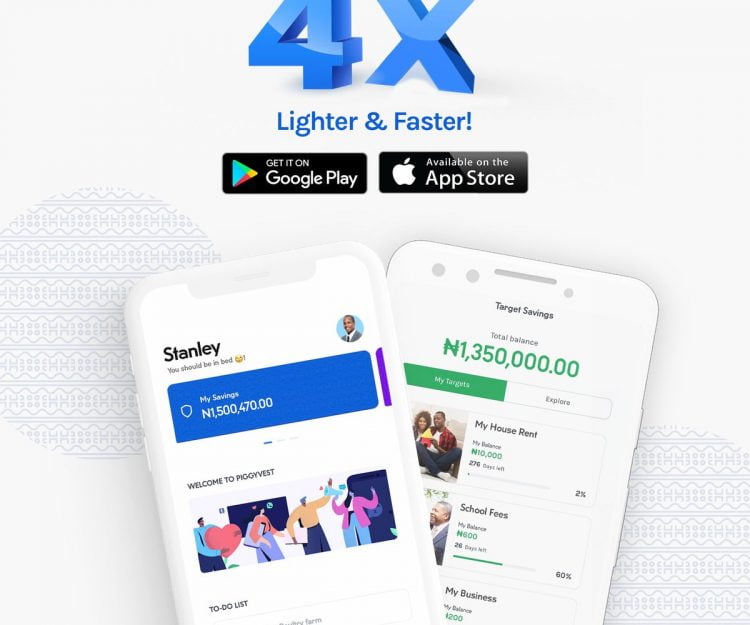

PiggyVest

A savings app that’s affiliated with UBA Nigeria Plc. It has a safety lock that enables you to lock parts of your money for a certain time.

If your account is locked, there are four withdrawal dates, once quarterly, and if you withdraw outside these dates, there’s a penalty fee of 5% of the withdrawal amount.

Available for both Android and iOS and requires no deposit or monthly fee.