As an individual or business owner, choosing the right tools for managing your finances is critical to learning how to efficiently use your resources. And it is a vital success strategy in life and business.

Financial or money management is a conscious self-discipline in handling money issues. It involves a good deal of regular record keeping; and monitoring your cash inflow and outflow. It may be done on paper. Or better still, there are desktop software and cloud-based tools that can simplify and hasten the process of managing your finances. Thus, they help in the efficient, safe, and hassle-free running of your business.

Managing one’s finances should never be ignored nor handled childishly by anyone who wants to be successful in personal life or business.

So – What is a Financial (Management) tool?

The Cflow website defines financial management tools as tools that:

“…help in tracking and managing financial transactions, making informed investment decisions, and creating budgets and saving plans.”

Also Read- How to Create a Successful Business Plan

Why Do You Need Tools for Managing Your Finances?

The Cflow site further states three reasons why financial management tools are critically needed:

“Financial tools for business help:

(1) to maintain the financial health of the organization by planning, organizing, controlling, and monitoring financial transactions.

(2) For profit maximization and cost savings, a steady cash flow needs to be maintained. By using the right tools in financial management, businesses can keep a tab on the inflow and outflow of cash and budget future expenses. Not just for managing business finances, there are several money management tools available for managing personal expenses. No matter the size and type of the organization, or the purpose, using financial management tools…

(3) is key to smooth business operations. From analysis to expense tracking, finance tools can be used in several ways.”

Below in this article, we have curated a list of the commonly used and indispensable tools for managing business/corporate finances. A good combination of the most vital tools is highly recommended for any business owner. For personal use, we also present four useful tools for financial management. Please choose the (collection of) software that fit into your budget and meet your needs at the same time. See the recommendations below.

Business-level Financial Management Tools

- Payroll management

- Accounting systems

- Expense tracking

- Budgeting tools

- Bill payment service (Easy Billing)

- Inventory tracking/management

- Tax preparation

- Interest calculators

- Cash flow analysis

- Financial dashboard

- Credit monitoring services

- Investment portfolio management

Personal Financial Management tools

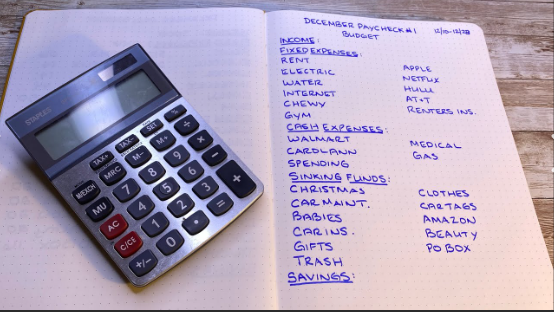

- Budgeting

- Expense management

- Smart saving

- Retirement planning

Here below is a brief clarification on what each tool is used for, backed with existing software in each category.

Payroll Management

Payroll management software is used to keep the records of all employees. Just as well, it calculates employees’ salaries, allowances, taxes, and deductions (based on each worker’s work contract and attendance records). It normally generates payslips as evidence (usually on a monthly or quarterly basis). Some of the best payroll tools available as we speak include CuteHR, Gusto, Paycom, Patriot software, Sage 50Cloud, QuickBooks and BambooHR.

Accounting Systems

Accounting tools are used to record, organize, and generate reports of all your daily transactions. Good accounting software can perform a range of tasks that include:

- tax calculation

- project management

- invoicing

- accounts reconciliation

- forecasting

- storing documents and receipts in digital form

- preparing reports and financial statements

- tracking expenses and income

and much more. Some of the best accounting software in the modern world include Sage Business Cloud, QuickBooks, Xero, FreshBooks, NetSuite ERP, Zoho, AvidXchange, and DocuPhase.

Expense Tracking

Expense tracking software helps you to record, categorize, and monitor all your expenditures across all accounts. Those accounts could include your investment accounts, bank accounts, even your debit and credit cards. Some of them have integrated budgeting and receipt keeping functionality, amongst others. Examples of modern expense trackers include Expensify, Mint, SAP Concur, Personal Capital, Wally, YNAB, QuickBooks Self-Employed, Marcus Insights, and Mvelopes.

Budgeting tools

A budgeting software is used for financial planning – to create, manage, and alter budgets. The budget itself is a plan of how to spend money judiciously to minimize waste or loss. The standard and common tool for budgeting is the spreadsheet – of which MS Excel and Google sheets are widely known examples. However, more rugged budgeting tools are available. They include Mint, PlanGuru, AccountEdge, BOARD, Budget Maestro, Adaptive Insights, NetSuite, Sage Anywhere, QuickBooks Enterprise, Multiview and Xledger.

Bill Payment Service (Easy Billing)

Bill payment tools/services help you to execute recurring or one-time electronic payment of bills automatically from your bank account. Banks and websites (e.g. e-commerce sites) often handle payment processing; so, they provide this facility for little or no extra cost. It is particularly useful for paying loans in installments, or regular utility bills. Notable bill payment tools of the modern world include Quicken, Paytrust, Prism, Mint, PocketGuard, and MyCheckFree.

Inventory Tracking /Management

Inventory management software monitors the stock or inventory levels in real-time. That is, as items are moved in and out of the inventory and as sales take place, the inventory tracker records every single movement. It often makes use of barcode scanners, point-of-sale (POS) terminals, electronic dashboards, and/or RFID (radio frequency identification) tags to record each sale or movement. It also helps in detecting any attempt to steal items. Top modern inventory tracking software include Acumatica, Lightspeed, QuickBooks Online, Cin7, SOS Inventory, SAP, Zoho Inventory, and Syspro.

Tax Preparation

Tax preparation software is used to prepare and present tax information, ready for payment (by individuals or organizations). The best modern tax preparation software includes the likes of TurboTax, Gusto, eFile.com, Intuit ProSeries Professional, TaxSlayer Pro, Drake Tax, H&R Block, ATX Tax, and Jackson Hewitt are among.

Interest Calculators

Interest calculators are used to calculate the interest rate (in real money) on a loan or savings balance. In the case of loans, it calculates the compound interest and the amount. Then it calculates the installmental payments for each month, till the loan is fully paid. Hence you will often find compound interest calculators embedded in loan apps (and websites of banks and investment platforms).

Cash Flow Analysis

Cash flow analysis tools are used to examine how cash flows in and out of a business. This is to determine the working capital of that company. The working capital is the amount of money available for carrying out any transactions or business operations. The simple formula for obtaining a business’s working capital, is to deduct all current liabilities from all current assets. However, that is beyond the scope of this article. Modern cash flow analysis tools include Xero, QuickBooks, Cube, Anchor, Causal, Fathom, Vena Solutions, Planful and Phocas.

Financial Dashboard

This is a financial intelligence tool used to visualize, track, understand, and report on financial data. It allows indepth analysis of financial data, to synthesize new information that can increase profits and reduce operating costs. Some good examples of modern financial dashboards include:

CFO Dashboard, CAGR Dashboard, Break-even Analysis dashboard, Cash Flow Valuation dashboard, Forecast Versus Expense dashboard, Profit Simulation dashboard, Margin Analysis dashboard, and Expense Detail Analysis dashboard.