The British colonial government laid the foundation of the Nigerian banking sector by establishing two foremost banks, beginning in 1892. Beyond this, banking operations in Nigeria have undergone several changes. It has witnessed a gradual transition from manual (and poorly regulated) operations, to computerized banking. Now it has progressed to a more security-conscious and faster automation powered by the internet.

Furthermore, banking facilities are progressively being extended to uneducated folks and citizens in remote locations and rural areas. These classes of people had aforetime suffered isolation from mainstream banking services. Many thanks to the introduction of mobile and internet banking; along with the new wave of fintechs spreading their reach all over the country.

At the Beginning: The First Generation of Banks in Nigeria

The African Banking Corporation (ABC) was the first bank to be set up in 1892, followed by The British Bank of West Africa (BBWA) in 1894. The BBWA has continued to survive over the years and with several name changes; but the ABC crashed not long after its setup. The BBWA was renamed Bank of West Africa (BWA) in 1957.

The early banks were solely inclined towards meeting the needs of the foreign investors that owned them. In the following years, the Nigerian government sought to increase local participation in these banks. Thus, the banks were instructed to allow Nigerian investors to acquire some of their shares. While a few of them complied, some foreign-owned banks refused to accept the new terms.

Mandatory Participation of Nigerian Investors in the Banking Industry Takes Off

In 1965, BWA was acquired by Standard Chartered Bank and renamed Standard Bank of West Africa (SBWA). Following the Nigerian Civil War, SBWA became Standard Bank of Nigeria. And was mandated by the Nigerian government to sell 13 percent of its share capital to Nigerian investors.

The move reduced Standard Chartered Bank’s investment in Standard Bank of Nigeria to just 38 percent, and the latter bank was again renamed First Bank of Nigeria in 1979. Standard Chartered Bank finally sold off its remaining shares in First Bank of Nigeria in 1996.

The present-day Union Bank of Nigeria was formed later on, preempted by the entrance of certain foreign banks into the country. These foreign banks had little interest in allowing Nigerians to enjoy their services. For instance, they refused to give credit facilities to Nigerians. Their discriminatory practices ran afoul of the Nigerian government’s desire to encourage the participation of local investors in banks.

The development led to an increased drive to set up indigenous banks entirely owned by Nigerians. Thus, at least 20 indigenous banks sprung up across Nigeria between 1927 and 1960. They included Agbonmagbe Bank (renamed Wema Bank) set up in 1945; United Bank for Africa (1949); and Sterling Bank (1960). Of these 20 banks, only four of them (including the three just mentioned) still exist to date.

Nigerian Banking Industry: The Onset of Banking Reforms

The unexpected crash of several banks before 1960 was due to factors bordering on poor management, fraud, and other key factors. It made local business owners (and potential investors) become wary of the banks. Thus, the Nigerian government set up two regulatory bodies for the banking industry in 1988. Namely the Securities and Exchange Commission (SEC), and the Nigerian Deposit Insurance Commission (NDIC). While the SEC was mandated to supervise capital market operations, the NDIC was charged with safeguarding depositors from the consequences of failed banks.

Unfortunately, more banks still buckled and failed due to issues bordering on fraud. Alarmed by such a recurrence, the government instituted an investigation into the crash of one of these banks. Reports generated from the investigation led to the enactment of the Banking Ordinance of 1952. Six years down the line, the Central Bank of Nigeria (CBN) was established in 1958. CBN commenced operation in 1959 and became the foremost regulatory body for the Nigerian banking sector.

The CBN implemented certain changes which included declaring a free market in the Nigerian banking sector. Several merchant and commercial banks became licensed. Rather than reverse the trend, the free market elicited another wave of abuses. Yet again, financial mismanagement, fraud, more bad loans, and undercapitalization plagued Nigerian banks and badly affected their customers.

Tighter Measures Introduced to Rescue the Nigerian Banking System

When Charles Chukwuma Soludo was elected Governor of the CBN in 2004, he embarked on new reforms. It was a 13-point agenda to strengthen the Nigerian banking system. Banks were mandated to increase their minimum paid-up share capital to 25 billion Naira (as against the former 2 billion Naira). That condition demanded the consolidation of several Nigerian banks. Thus before the year 2005 ended, the number of banks in Nigeria reduced from 89 to 25.

A Giant Step Forward: Fintechs and Cashless Solutions Enter the Nigerian Banking System

The greatest degree of penetration and availability of banking services made available to Nigerians became possible through financial technology (Fintechs). These fintech platforms provide banking and financial services with the use of computer programs and other modern cutting-edge technology tools. Such tools include cloud computing, artificial intelligence, blockchain technology, and big data – all of them running on the backbone of internet and mobile connectivity. Fintechs have become readily accessible using internet-enabled mobile devices and computers.

The forerunner of fintechs was the formation of SmartCard (which became ValueCard, then renamed Unified Payment Services) by a consortium of banks in 1997. It ushered in the era of branchless transactions and cashless payments in Nigeria. Thus, a customer could now transact from any branch of a bank, regardless of which branch he/she opened his/her account.

Furthermore, electronic payment for goods and services became possible using ValueCard branded ATM cards, and the first set of Point-of-Sale terminals in the country. Unified Payment Services formed alliances with global cashless service providers namely Visa, Mastercard, China Union Pay, and American Express between 1997 and 2018.

Along the line, automated teller machines (ATMs) were also introduced by the now defunct Societe General Bank Nigeria in 1989. The move forced many Nigerian banks to adopt ATMs in order to meet the needs of their teeming customers. Thus began the transition from unreliable manual operations and paperwork, to internet-powered electronic transactions.

From Year 2000 Till Now: A Proliferation of Nigerian Fintechs

And in 2002, Mitchel Elegbe set up Interswitch. Interswitch was the first fintech to kick-start an interoperability platform – where one card could be used on several ATMs belonging to different banks. Following this move, other fintech platforms arose to support cashless transactions across the country. They include Paga, Remita, and eTranzact. However, this second generation of fintechs were still very much inaccessible to thousands of Nigerians.

But between 2014 and 2016, Paystack and Flutterwave joined the revolution, and they opened the door for more Nigerians to benefit from fast and simplified digital banking services. Several other fintechs have emerged since then. Additionally, a set of digital banks (or neobanks) arose beginning with ALAT by Wema bank in 2017. These were the third set of fintechs in Nigeria. Their proliferation allowed customers to access simplified banking services from anywhere without going to a physical branch.

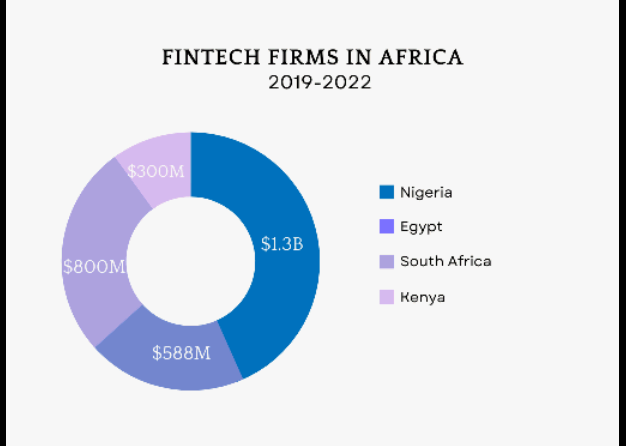

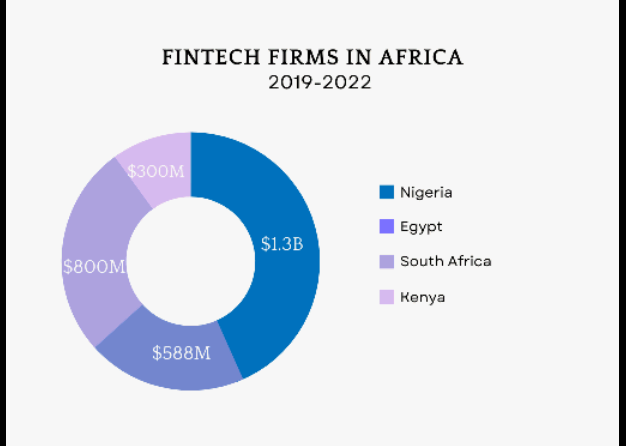

The likes of Kuda, Eyowo, Opay, Sparkle, VBank, Carbon, Rubies, OneBank, and scores of others have joined the race. There are now over 200 fintech companies, enablers, and stakeholders in Nigeria as we speak. Furthermore, Nigeria is currently the largest fintech hub in Africa. According to Fintech Times, Nigeria was able to raise 1.37 billion US Dollars in venture capital and funding between 2019 and 2022 – the highest across Africa so far. Yet again, the Frost and Sullivan project estimated that revenue in the Nigerian fintech space would exceed 543.3 million US Dollars by the end of 2022.

In spite of the initial reluctance by many people to make use of digital banking services, patronage of fintechs has continued to soar. Furthermore, the COVID-19 era was highly instrumental in convincing innumerable customers to use alternative cashless payment channels (in the absence of physical cash).

A Bright Future for Nigerian Fintechs: Final Words

Nigerian fintechs continue to play a strong role in improving financial inclusion for the large numbers of still underbanked people in the country. The statistics of people who have access to banking services in Nigeria has greatly improved. However, a recent report states that about 26 percent of the Nigerian population are still underbanked as of the end of 2023. There is plenty of opportunity for Nigerian fintechs to enroll this category of citizens, by providing simplified conditions for account opening.

They can also provide several financial support services to facilitate other sectors of the economy. Namely insurance, utility bills, school fees, healthcare, e-commerce, loan and credit facilities (to business owners and employees), mobile top up, amongst others.